Assessment test

Take a short informative test with a series of questions and check if you belong to the freelancer category.

*The test can be done an unlimited number of times.

News

Tax calculator

The informative tax calculator should help you calculate the total amount of taxes and contributions in relation to the income you earned in the previous quarter.

Calculate the taxThe guide provides answers to key questions such as who is considered a freelancer, who can be an income payer, what rights freelancers have, how to apply for insurance, what self-taxation options are available to you, etc..

See the GuideHere you can find useful documents that will provide you with more detailed information about the new self-taxation regime for freelancers.

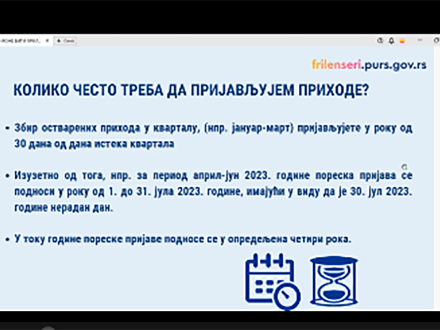

Explore the documentsTAX APPLICATION

In the Tax application section, you can report the income you earned in the previous quarter.

You can find more information on the link Tax application.

Sign up for insurance

The application is made electronically through the Central Register of Mandatory Social Insurance (CROSO), and you can also apply for insurance directly through the CROSO portal.

You can also register with the mandatory social insurance organization by going to the branches of the Pension and Invalidity Insurance Fund or the Health Insurance Fund.

FAQ

This section contains a list of frequently asked questions and answers.

WHO IS A "FREELANCER", I.E. A NATURAL PERSON THAT GENERATES INCOME BASED ON AGREED FEE FOR COPYRIGHT AND RELATED RIGHTS AND THE AGREED FEE FOR PERFORMED WORK?

For the purpose of this Guide, the term freelancer will be used for three categories of persons:

- domestic natural person – resident of the Republic of Serbia, generating income by working in the Republic of Serbia, with income paid by a payer abroad (legal entity, entrepreneur or a natural person) or a domestic natural person, or another person that is not subject to calculation and payment of taxes and contributions in the Republic of Serbia when paying income;

- domestic natural person - resident of the Republic of Serbia, generating income by working in another country, from a payer from abroad (legal entity, entrepreneur or a natural person), or another person that is not subject to calculation and payment of taxes and contributions in the Republic of Serbia when paying income;

- foreign natural person – non-resident, generating income by working in the Republic of Serbia, with income paid by a payer abroad (legal entity, entrepreneur or a natural person) or a domestic natural person, or another person that is not subject to calculation and payment of taxes and contributions in the Republic of Serbia when paying income.

o We highlight that the term „freelancer“ is not a legally defined term, hence it will not be found in any official regulation.

For the purpose of creating this Guide, the term „freelancer“ is used in an informal sense, for natural persons generating income from persons that are not subject to calculation and payment of taxes and contributions in the Republic of Serbia when paying income.

Abroad, the term freelancers is colloquially used for natural persons who are not officially employed by an employer, but perform jobs and activities based on and in accordance with a written or oral engagement contract.

WHO CAN BE THE PAYER OF INCOME SUBJECT TO THIS REGIME OF SELF-TAXATION TO THE FREELANCER?

In accordance with Article 100a, Paragraph 1, Item 2) sub-item (1) and (3) and Paragraph 2 of the Law on Citizens' Income Tax through the portal www.frilenseri.purs.gov.rs, a freelancer can submit a tax return for income paid to them by:

- a legal entity from abroad (a company; non-government organization; international organization; foreign country; foreign local government body, diplomatic or consular representation of a foreign country and international organization, etc.);

- an entrepreneur from abroad (a natural person who has a registered activity abroad: e.g. programmer; translator; lawyer, etc.);

- a natural person from abroad (foreign citizen, regardless of whether or not they reside in the Republic of Serbia);

- a domestic natural person;

- another person who, when paying income, does not calculate and does not pay withholding tax and contribution obligations in the Republic of Serbia.

The portal www.frilenseri.purs.gov.rs should not be used to submit tax application for the income a freelancer receives from entities that, according to Article 99 of the Law on Citizens' Income Tax, have the obligation to calculate and pay withholding taxes and contributions. These include the following types of payer:

- domestic legal entity (company, citizens' association, public administration body, state body, etc.);

- domestic entrepreneur (a natural person who has a registered activity in the Republic of Serbia, that is, an entrepreneur or a flat-rate entrepreneur);

a branch or representative office of a foreign legal entity registered in the Republic of Serbia (permanent business unit), because that entity has the obligation to calculate and submit a withholding tax application according to tax regulations.

SHOULD I USE THE PORTAL TO REPORT INCOME PAID IN CASH?

Through the portal, you report income paid in money, goods, services, deeds or otherwise.

WHAT OBLIGATIONS DO I HAVE BASED ON INCOME?

The obligations you will have based on mandatory social insurance depend on three factors:

- whether you are a resident or a non-resident;

- whether your place of work is in Serbia or abroad;

- whether you are insured on another basis.

In this regard, below is a tabular overview of the rights and obligations that you exercise, depending on the answers to the previous three questions.

|

Type of recipient/payer |

Liability |

||

|

Tax |

Pension and disability insurance |

Health insurance |

|

|

A resident with a place of work in Serbia, who is not health insured on another basis, for income from domestic payers |

Yes |

Yes |

Yes |

|

A resident with a place of work in Serbia, who is health insured on another basis, for income from domestic payers |

Yes |

Yes |

No |

|

A resident with a place of work in Serbia, who is not health insured on another basis, for income from abroad |

Yes |

Yes |

Yes |

|

A resident with a place of work in Serbia, who is health insured on another basis, for income from abroad |

Yes |

Yes |

No |

|

A resident with a place of work abroad, who is not health insured on another basis [1][2] |

Yes |

No |

Yes |

|

A resident with a place of work abroad, who is health insured on another basis |

Yes |

No |

No |

|

A non-resident with a place of work in Serbia, who is not health insured on another basis, for income from domestic payers |

Yes |

Yes |

Yes |

|

A non-resident with a place of work in Serbia, who is health insured on another basis, for income from domestic payers |

Yes |

Yes |

No |

[1] The obligation to pay health insurance depends on whether Serbia has concluded an agreement on social insurance with that country. If there is no agreement with that country, you are obliged to pay health insurance contributions. If there is an agreement that also includes health insurance (since there are agreements that only include pension and disability insurance), you should submit proof that you have health insurance in that country, so as not to pay a contribution for health insurance in Serbia.

[2] The contribution for pension and disability insurance is not paid if the place of work is outside the territory of the Republic of Serbia and you do not exercise the right based on pension seniority.

Ask us a question

Through the contact form, you can send an inquiry to the Tax Administration for any doubts you have regarding the income you earn as a freelancer.

Enter the required data in the contact form. After the inquiry has been successfully sent, you will receive a confirmation to your email that the inquiry has been sent and that you will receive an answer as soon as possible.

Before sending a query, check if the answer to your question is in the Frequently Asked Questions and Answers section or in the Guide in the Useful Documents section.